Metropolis Office Requirements – H1

September 2, 2015 Leave a comment

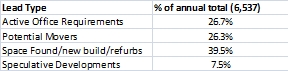

Over 450 companies vie for London space

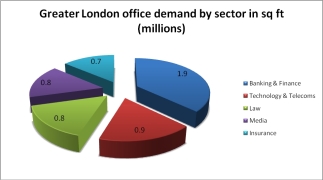

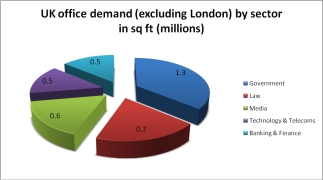

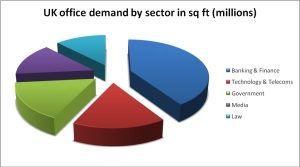

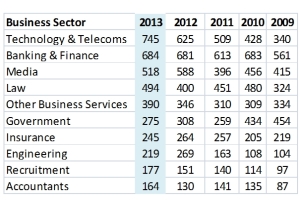

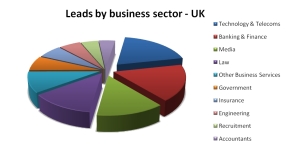

Metropolis research identified over 17m sq ft of UK office demand in the first half of 2015. Just over 9.2m sq ft of this demand was for office space in Greater London, with over 450 companies searching for London space. In the rest of the UK Metropolis uncovered 400 requirements for new space representing 8.1m sq ft of office demand.

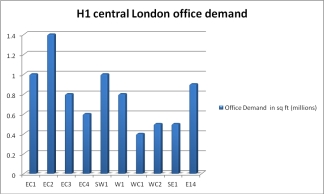

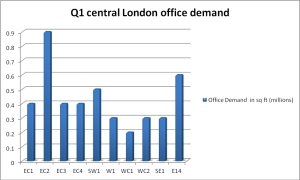

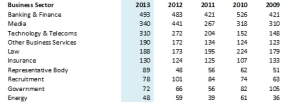

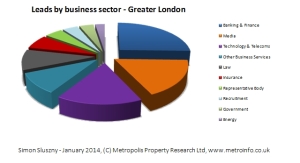

Central London office demand reached 8m sq ft, 3.8m sq ft (47.5%) of which was focused on the City of London. EC2 was the most popular postcode for companies planning a move, with 1.4m sq ft of demand emerging in H1.

A significant proportion of total City of London demand (11%) came from two new law firm requirements, each firm looking for 200,000 sq ft. A new 150,000 sq ft requirement from an insurance group was also worthy of note. Demand from the banking and finance sector reached 1m sq ft, 26% of total City of London demand.

Demand for space in the West End, where rents can reach £125 psf, hit 1.8m sq ft. The largest West End requirement (150,000 sq ft) came from a social media group looking for offices in SW1. Just over 400,000 sq ft of office space (26% of total demand) was required by the banking & finance sector, 79% of which (315,000 sq ft) came from hedge funds and private investment firms.

Mid Town office demand reached 0.9m sq ft, pretty evenly split between WC1 and WC2. About 100,000 sq ft of Mid Town demand came from the technology sector and 90,000 sq ft from the media sector. Demand from law firms was just over 120,000 sq ft and demand from the banking and finance sector totalled 110,000 sq ft.

The largest office requirement in the South Bank (SE1) was a 140,000 sq ft search by an engineering and construction firm. Other requirements of note include a US insurance firm switching a 60,000 sq ft search from Maidenhead to London SE1, and a TV Broadcaster looking for 30,000 sq ft to house its news department.

Two big requirements dominated demand for office space in the Docklands: a German investment bank back office requirement for 350,000 sq ft and an information company requirement for 300,000 sq ft, with a sub-let mooted.

The Top 5 Regional Cities

Manchester – The largest requirement, 400,000 sq ft, was a search by a government department considering space near Piccadilly Station in Manchester. Just over 250,000 sq ft of Manchester office demand came from the legal sector and 300,000 sq ft of demand was attributed to the insurance sector.

Edinburgh – Similar to the picture in Manchester, Edinburgh demand was dominated by a large government requirement for office space (300,000 sq ft), although this requirement could move to Glasgow. In terms of private sector demand, notable requirements included a 100,000 sq ft search by a US Bank and two significant searches from law firms seeking a move in central Edinburgh, one for 50,000 sq ft and the other 30,000 sq ft. There was also significant demand from the accountancy sector, with four firms searching for just over 130,000 sq ft.

Birmingham – A retail bank was linked with the largest office requirement in Birmingham: 170,000 sq ft, a search now satisfied by space at Miller Developments Arena Central scheme. Other significant requirements include a potential 100,000 sq ft search from a law firm and a 50,000 sq ft search from a business education group.

Reading – The largest requirement for Reading offices came from a network broadcaster looking for 150,000 sq ft, closely followed by a utility company searching for 140,000 sq ft. Both requirements also consider other Thames valley locations such as Bracknell, Farnborough and Slough.

Bristol – Bristol office demand was dominated by insurance company requirements, with the sector accounting for 56% of total demand (280,000 sq ft). Other notable requirements include an 80,000 sq ft search from a Bristol based law firm planning to combine two of its offices (which may now be a refurbishment and extension of the existing building) and an engineering group searching for 25,000 sq ft.

Top Ten Cities (Excluding London) by H1 Office Demand

Copyright Metropolis Property Research Ltd 2015

Rise of the pre-let

February 7, 2019 Leave a comment

Recent research by Metropolis revealed that a total of 133 occupiers were involved in pre-let searches or deals during 2018. These included a wide variety of moves across the whole of the UK. In London, a record breaking 39 pre-let deals were signed during 2018 totalling 3.8m sq ft, ahead of the previously record-breaking 2.74 million sq ft of pre-lets agreed in 2013.

Reasons given by occupiers for the risingof pre-lets are varied, but include upcoming lease events, continued limited new developments coming on the market and faith in London. It is clear that tech and media firms are making significant long-term commitments to new buildings, alongside traditional City occupiers, including those in the insurance and financial sectors. 2018 was the year that global brands made big commitments, including the likes of real estate-savvy Facebook and Sony both committing to new European headquarters in the West End and King’s Cross.

Metropolis has identified up to 50 named occupiers, which have on-going London searches, which could sign pre-lets on under construction, new or newly refurbished office space in 2019.

Recent research by Cushman & Wakefield indicated that over the last ten years there has been a total of 24.4 million sq ft of office space let pre-let transactions completed. On average, there were 27

pre-lets each year over this period, with the peak being 2013 and 2014. Pre-letting is more common in the City, Docklands and City fringe, than in the West End.

Large pre-lets from TMT (tech, media and telecom) companies in recent years including Apple’s acquisition at Battersea Power Station (475,000 sq ft), Dentsu Aegis Network’s 312,000 sq ft deal at 1 Triton Square, Linkedin in Farringdon and Facebook’s recent commitment at King’s Cross (600,000 sq ft). Banking & financial occupiers were the next most active sector, accounting for 31% of total pre-let volumes over the last ten years, including Deutsche Bank’s future relocation into 21 Moorfields (469,000 sq ft), SMBC’s acquisition at 100 Liverpool Street (161,000 sq ft), Wells Fargo and TP ICAP’s pre-let of part of 135 Bishopsgate (122,000 sq ft).

Public sector and government occupiers have also driven pre-let volumes, including large-scale consolidations from HMRC, FCA and TfL, as well as the Chinese Embassy’s transaction at Royal Mint Court.

King’s Cross is one of the most popular desinations for new office stock secure pre-let in recent years, including deals in 2018 to Nike (63,000 sq ft), Facebook, Google, Spaces and WeWork. West End submarkets such as White City, Battersea and Nine Elms have have also attracted significant pre-lets including in 2018, Penguin Random House (83,000 sq ft).

It is clear that occupiers are looking beyond the traditional core office markets. Banking & financial occupiers took the largest share of tower pre-lets over the last 10 years with 32% of total volumes, matched by insurance companies (32%). Some 17% of lettings were prelet prior to construction and 29% let during the construction process, compared to 54% let post completion.

Outside of London, Barclays pre-let 470,000 sq ft at Buchanan Wharf in Glasgow. The new campus complex will house existing Glasgow staff along with new positions created in technology and operations functions. in Manchester, Booking.com has pre-let 222,000 sq ft at St John’s Building, as the new global headquarters for its ground transportation division, consolidating four offices around the city.

Research has revealed that larger occupiers are considering their options 3-4 years ahead of a move, especially if the target is a move in the core districts. Trends also include some smaller pre-lets with shorter leases, particularly whilst schemes are under construction. Competition for core space is making fringe locations more desirable, especially with the possibility of rental savings.

Metropolis is currently tracking over 100 occupiers looking for over 20,000 sq ft of offices in 2019-20, more than half of which could consider a pre-let.

Paul Ives Metropolis Head of Research – paul@metroinfo.co.uk

Filed under CityOffices.net News, Market Comment, Metropolis Market Reports Tagged with 2018, 2019, Apple, banking, central London office blog, City, deald, Facebook, market Cushman, Metropolis movers, office market blog, pre-lets, tech