Law firms intensify demand

March 11, 2015 Leave a comment

A recent report by property consultant CBRE underlines recent Metropolis research on the law sector in London.

The report highlights law firms efforts to use their space more efficiently as well as using lease events to rebuild IT networks and change working methods. The report also estimates there are currently 24 medium/large office requirements by law firms in central London (Metropolis is currently tracking 28 searches over 10,000 sq ft in London), including DLA Piper, Withers and Ashurst.

Nearly 800,000 sq ft of central London office space was let to law firms in 2014 (a similar level to 2013) including: Mishcon De Reya taking 116,000 sq ft at Africa House, Kingsway; HowardKennedyFsi’s 54,600 sq ft letting at 1 London Bridge; Ropes & Gray’s 45,000 sq ft pre-let at One New Ludgate; DWF’s 43,000 sq ft deal at 20 Fenchurch Street. In addition, Boodle Hatfield took 23,000 sq ft at 240 Blackfriars, and Radcliffe’s le Brasseur agreed a deal to take 29,000 sq ft at 85 Fleet Street.

In addition, a wave of law mergers has led to a number of firms bringing two previously separate operations together under one roof. There are currently over a dozen mergers at various stages and some recent examples include Locke Lord and fellow US law firm Edwards Wildman; Morgan Lewis and Bingham McCutcheon, as well as Charles Russell and Speechly Bircham.

Looking ahead, a number of firms are saying they plan to re-gear leases at impending renewal including Simpson Thatcher & Bartlett, Dechert, Watson Farley & Williams, and Kirkland & Ellis. There has been a gradual trend to dispose of surplus space in recent years. However, there is nearly 5m sq ft of lease expiries and break options, amongst law firms, approaching in the next five years, so activity looks likely to be brisk and deliberations often start early. CBRE’s survey work indicates that discussions may begin four or five years ahead of any lease event, with the broadest possible consultation among the firm’s partners and lawyers.

Metropolis forecasts that with the combination of lease expiries, expansions, mergers and new market entrants; law sector office moves could reach an average of nearly 1m sq ft per annum in central London over the next few years.

Metropolis Office Requirements – H1

September 2, 2015 Leave a comment

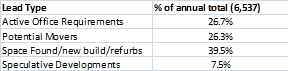

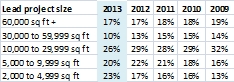

Over 450 companies vie for London space

Metropolis research identified over 17m sq ft of UK office demand in the first half of 2015. Just over 9.2m sq ft of this demand was for office space in Greater London, with over 450 companies searching for London space. In the rest of the UK Metropolis uncovered 400 requirements for new space representing 8.1m sq ft of office demand.

Central London office demand reached 8m sq ft, 3.8m sq ft (47.5%) of which was focused on the City of London. EC2 was the most popular postcode for companies planning a move, with 1.4m sq ft of demand emerging in H1.

A significant proportion of total City of London demand (11%) came from two new law firm requirements, each firm looking for 200,000 sq ft. A new 150,000 sq ft requirement from an insurance group was also worthy of note. Demand from the banking and finance sector reached 1m sq ft, 26% of total City of London demand.

Demand for space in the West End, where rents can reach £125 psf, hit 1.8m sq ft. The largest West End requirement (150,000 sq ft) came from a social media group looking for offices in SW1. Just over 400,000 sq ft of office space (26% of total demand) was required by the banking & finance sector, 79% of which (315,000 sq ft) came from hedge funds and private investment firms.

Mid Town office demand reached 0.9m sq ft, pretty evenly split between WC1 and WC2. About 100,000 sq ft of Mid Town demand came from the technology sector and 90,000 sq ft from the media sector. Demand from law firms was just over 120,000 sq ft and demand from the banking and finance sector totalled 110,000 sq ft.

The largest office requirement in the South Bank (SE1) was a 140,000 sq ft search by an engineering and construction firm. Other requirements of note include a US insurance firm switching a 60,000 sq ft search from Maidenhead to London SE1, and a TV Broadcaster looking for 30,000 sq ft to house its news department.

Two big requirements dominated demand for office space in the Docklands: a German investment bank back office requirement for 350,000 sq ft and an information company requirement for 300,000 sq ft, with a sub-let mooted.

The Top 5 Regional Cities

Manchester – The largest requirement, 400,000 sq ft, was a search by a government department considering space near Piccadilly Station in Manchester. Just over 250,000 sq ft of Manchester office demand came from the legal sector and 300,000 sq ft of demand was attributed to the insurance sector.

Edinburgh – Similar to the picture in Manchester, Edinburgh demand was dominated by a large government requirement for office space (300,000 sq ft), although this requirement could move to Glasgow. In terms of private sector demand, notable requirements included a 100,000 sq ft search by a US Bank and two significant searches from law firms seeking a move in central Edinburgh, one for 50,000 sq ft and the other 30,000 sq ft. There was also significant demand from the accountancy sector, with four firms searching for just over 130,000 sq ft.

Birmingham – A retail bank was linked with the largest office requirement in Birmingham: 170,000 sq ft, a search now satisfied by space at Miller Developments Arena Central scheme. Other significant requirements include a potential 100,000 sq ft search from a law firm and a 50,000 sq ft search from a business education group.

Reading – The largest requirement for Reading offices came from a network broadcaster looking for 150,000 sq ft, closely followed by a utility company searching for 140,000 sq ft. Both requirements also consider other Thames valley locations such as Bracknell, Farnborough and Slough.

Bristol – Bristol office demand was dominated by insurance company requirements, with the sector accounting for 56% of total demand (280,000 sq ft). Other notable requirements include an 80,000 sq ft search from a Bristol based law firm planning to combine two of its offices (which may now be a refurbishment and extension of the existing building) and an engineering group searching for 25,000 sq ft.

Top Ten Cities (Excluding London) by H1 Office Demand

Copyright Metropolis Property Research Ltd 2015

Filed under Market Comment, Metropolis Market Reports Tagged with banking, Business, Business and Economy, City of London, Cityoffices, Cityoffices.net, commercial agent, Edinburgh, finance, law, Leeds, letting deals, lettings, London, Manchester, media, Metropolis, metropolis property research, office, office build, office construction, office instruction, office leads, office market, office market data, office move, office moves, office refurbishment, office relocation, office requirements, office scheme, office search, office space, offices, Private sector, property deals, refurbishment, relocation, requirements, searches, sq ft, Square foot, Thames Valley, TMT