Metropolis Office Requirements – H1

September 2, 2015 Leave a comment

Over 450 companies vie for London space

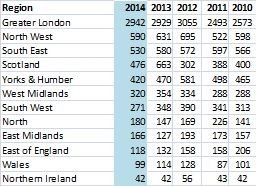

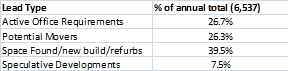

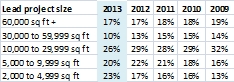

Metropolis research identified over 17m sq ft of UK office demand in the first half of 2015. Just over 9.2m sq ft of this demand was for office space in Greater London, with over 450 companies searching for London space. In the rest of the UK Metropolis uncovered 400 requirements for new space representing 8.1m sq ft of office demand.

Central London office demand reached 8m sq ft, 3.8m sq ft (47.5%) of which was focused on the City of London. EC2 was the most popular postcode for companies planning a move, with 1.4m sq ft of demand emerging in H1.

A significant proportion of total City of London demand (11%) came from two new law firm requirements, each firm looking for 200,000 sq ft. A new 150,000 sq ft requirement from an insurance group was also worthy of note. Demand from the banking and finance sector reached 1m sq ft, 26% of total City of London demand.

Demand for space in the West End, where rents can reach £125 psf, hit 1.8m sq ft. The largest West End requirement (150,000 sq ft) came from a social media group looking for offices in SW1. Just over 400,000 sq ft of office space (26% of total demand) was required by the banking & finance sector, 79% of which (315,000 sq ft) came from hedge funds and private investment firms.

Mid Town office demand reached 0.9m sq ft, pretty evenly split between WC1 and WC2. About 100,000 sq ft of Mid Town demand came from the technology sector and 90,000 sq ft from the media sector. Demand from law firms was just over 120,000 sq ft and demand from the banking and finance sector totalled 110,000 sq ft.

The largest office requirement in the South Bank (SE1) was a 140,000 sq ft search by an engineering and construction firm. Other requirements of note include a US insurance firm switching a 60,000 sq ft search from Maidenhead to London SE1, and a TV Broadcaster looking for 30,000 sq ft to house its news department.

Two big requirements dominated demand for office space in the Docklands: a German investment bank back office requirement for 350,000 sq ft and an information company requirement for 300,000 sq ft, with a sub-let mooted.

The Top 5 Regional Cities

Manchester – The largest requirement, 400,000 sq ft, was a search by a government department considering space near Piccadilly Station in Manchester. Just over 250,000 sq ft of Manchester office demand came from the legal sector and 300,000 sq ft of demand was attributed to the insurance sector.

Edinburgh – Similar to the picture in Manchester, Edinburgh demand was dominated by a large government requirement for office space (300,000 sq ft), although this requirement could move to Glasgow. In terms of private sector demand, notable requirements included a 100,000 sq ft search by a US Bank and two significant searches from law firms seeking a move in central Edinburgh, one for 50,000 sq ft and the other 30,000 sq ft. There was also significant demand from the accountancy sector, with four firms searching for just over 130,000 sq ft.

Birmingham – A retail bank was linked with the largest office requirement in Birmingham: 170,000 sq ft, a search now satisfied by space at Miller Developments Arena Central scheme. Other significant requirements include a potential 100,000 sq ft search from a law firm and a 50,000 sq ft search from a business education group.

Reading – The largest requirement for Reading offices came from a network broadcaster looking for 150,000 sq ft, closely followed by a utility company searching for 140,000 sq ft. Both requirements also consider other Thames valley locations such as Bracknell, Farnborough and Slough.

Bristol – Bristol office demand was dominated by insurance company requirements, with the sector accounting for 56% of total demand (280,000 sq ft). Other notable requirements include an 80,000 sq ft search from a Bristol based law firm planning to combine two of its offices (which may now be a refurbishment and extension of the existing building) and an engineering group searching for 25,000 sq ft.

Top Ten Cities (Excluding London) by H1 Office Demand

Copyright Metropolis Property Research Ltd 2015

Metropolis London Skyline Report

December 11, 2015 Leave a comment

The London Wrecking (Christmas) Ball

or “What Comes Down Must Go Up”

abridged

Metropolis and Cityoffices have completed their bi-annual ‘Skyline’ survey of the central London office development market for the period April 2015 to October 2015. The survey takes a snapshot of the central London office construction in Q4 2015, recent completions, recent pre-letting activity and looks ahead to future pipeline projects that will shape the next three years.

There are now 78 office schemes under construction in central London (compared to 74 six months ago) totaling an increased 11.1m sq ft (9.5m sq ft in April 2015). In the last six months there have been 31 new scheme starts, totaling 3.4m sq ft, including major new-builds such as the 866,000 sq ft 100 Bishopsgate in EC3, the 400,000 sq ft 10 Fenchurch Place in the City of London and the 228,000 sq ft 33 King William Street (33 Central) in EC4.

The City dominates construction with 6m sq ft of new office space in schemes now underway (up from 4m sq ft in early 2015). There is now 500,000 sq ft of office space under construction at Kings Cross, with more at site clearance stage. The West End, including Paddington, has 2.7m sq ft under construction and a further 600,000 sq ft of office build is on-site in Midtown, but Southbank and Docklands still lag behind the rest of London.

The big story is the forthcoming space at demolition stage, with over 7m sq ft lined up to start in early 2016 and more to follow later in the year. In reality, further schemes currently at planning stage will add to these numbers, particularly the 2017 and 2018 totals. Therefore we expect development completions in 2017 and 2018 could reach 7-8m sq ft.

Looking ahead, some 33 future schemes are currently at site preparation stage with 7.2m sq ft of additional office space due to go under construction in the next 6 months. Many of these schemes will not be completed until 2017 or 2018, however it is clear there is a strong development pipeline.

The full Skyline report is currently available to Metropolis clients. Further details on the Metropolis service can be found at http://www.metroinfo.co.uk.

Copyright Metropolis Property Research Ltd 2015

Filed under CityOffices.net News, Market Comment, Metropolis Market Reports Tagged with available office space, Business and Economy, Central London, City, City of London, Cityoffices.net, commercial property, demolition, office accommodation, office build, office project, office research, office scheme, office space, offices, refurbishment, sq ft, take-up, wrecking ball